Personal Finance

Warren Buffett's Business Partner: The World is No Longer Run by Greed, But by Envy (And What You Can Do About It)

We are in the spotlight

Warren Buffett’s counterpart at Berkshire Hathaway, Charlie Munger, spoke at the Daily Journal’s annual meeting in March of 2022. During that meeting, he went on the describe how culture has shifted over the course of the last 100 years and what it is truly driving society nowadays. In that conference, he stated, “The world is no longer driven by greed, but by envy.” But what does he mean by that and why is his insight so important, compared to what another expert could state? Before getting into what he means, let’s talk about Charlie Munger and why he is such a reliable source when it comes to the inner workings of the world and how he takes his vast array of experience to get a deep understanding of how people, financial markets and the world operates. There are not many people in the world who are able to see the world holistically and how everything within it works cohesively with each other. Most people in life tend to think that most of how the world works is because of cause and effect. They see gas prices go up and they believe it is due to there being a gas shortage, or a higher demand for gas. Or when stores start charging more for their items, that it is either due to inflation or due to companies lining their pockets. This is what some would consider to be a linear thinking style. On the contrary, there are a few people who are able to look at the wider scope of things and understand how they all intertwine together. These types of people are considered circular thinkers. They take a more global perspective and tie in all the various elements of how the world works and combine them together, to get a deep understanding of the way things work, from one industry to the next and from one country to another, at a global landscape. Most of these people take this information and translate it back to their set area of expertise.

Charlie Munger, the man behind (a great deal of) Warren Buffett’s success, made a bold statement about how the world is no longer ran by greed. This four-letter word leaves us silent in our words, but at a high risk of overspending.

The Two Primary Ways People Think – And How It Widely Changes the Perspective One Has in Life

Finance behemoths like Bloomberg and the Wall Street Journal make you pay to learn about finance. We share our insights to expand your financial literacy for free.

For people like my former employer, he took his circular thinking and created a deep understanding of how stocks move, and got to a point where he was so deep into human psychology and the movements of markets, that he could associate a probability upon the two opposing directions a stock could take for the next day, and forecast a stock moving into the direction with higher probability at a certain price with a high level of accuracy. One of my other friends made a video back in 2011 in a training program and predicted when the price of Bitcoin would hit a certain number by a certain year, and it did, in the exact time frame in the future. For Charlie Munger, Warren Buffett’s business partner who makes very few public appearances, he encapsulates all the ideal characteristics of a circular thinker; however, his skills go even beyond that. Most people who are circular thinkers tend to be stoic and keep to themselves. Charlie Munger, on the other hand, is also an expert-generalist as well to being a circular thinker. There are even fewer expert-generalists than there are circular thinkers. An expert-generalist, according to Orit Gadiesh, chairman of Bain & Co, who is quoted in this Forbes article by Michael D. Simmons, describes the expert-generalist as: “Someone who has the ability and curiosity to master and collect expertise in many different disciplines, industries, skills, capabilities, countries, and topics., etc. He or she can then, without necessarily even realizing it, but often by design: I may have quite a different take than most people. People say that Warren Buffett is the reason that Berkshire Hathaway reached its current level of success it is. My personal take is that Warren Buffett’s success is heavily derived from Charlie Munger’s ability to look at the world circularly, combined with his deep expertise in a plethora of fields. Charlie Munger doesn’t just like reading; he loves diving deep into connecting with other humans and draws out a lot of depth that the ordinary person cannot see when it comes to what is going on in the world. Being someone who is so highly respected in the world of finance, he has had a lot of difficult conversations with executives at publicly traded companies. And he is much closer than most people when it comes to a deep understanding of how our world operates. Back when Milton Friedman declared that “greed is good” back in the 1970s, it led to many of the transitions we’ve seen companies make up to this point, such as outsourcing our American jobs overseas and the overly overt displays of competition for one company to take additional market share from one other. From 2007 to 2017, 57% of American companies increased their use of outsourcing, with around 2.4M American jobs being taken overseas (Brandon Gaille, 2017). Through the past half-decade, things have changed quite dramatically. We’ve seen uprisings and mantras come out, where people have banded together and came up with slogans, such as, “eat the rich” and so forth. Companies have taken a deep look into how they have been operated and a lot of things have changed. It might not look that way now, as prices have increased across the board for the things we tend to purchase.Why Warren Buffett’s Business Partner, Charlie Munger, has a Deep Understanding of How the World Works – And Why You Should Care

The Origins of Greed in the Stock Market and How It Affected Corporations and Brands at Large

We empower new and seasoned investors to take charge of their finances.

Get the most reliable financial resources delivered straight to your inbox.

A loaf of French bread went from $1.50 at the Vons next to my home in Los Angeles, to $2.50. A 16-ounce Coca-Cola has increased in price from $1 to $2.25-$.250 at the convenience stores around town. Gas has reached record numbers – and in Los Angeles at least, restaurants have increased their prices by around 30 percent across the board. From my perspective, I understand why these price changes had to be made. Restaurants were unable to provide anything aside from takeout for about six months in Los Angeles, so they ate through their cash reserves. There were supply chain issues that caused the cost of goods to increase temporarily. Food costs have increased so much that you are no longer able to find the five or 99-cent deal for green onions at the Korean grocery store, which tends to be a lot cheaper than its American counterparts. When the Korean grocery store is affected, you are able to understand that this isn’t something that corporations are doing by choice; it’s affecting everyone across the line. Yet through the end of 2022, things have changed significantly in our economy. The costs for international shipping have gone down to where they were before the pandemic became a thing, and many companies like Coca-Cola have recouped their stock prices to where they were before they took losses during the economic downturn. As consumers and investors, we have to understand that the number one primary objective of any company is beholden to its shareholders. That stock price is essential to their success, and if we have any type of investment portfolio set up on our own or through an advisor, then it is to our own success as well. While it would be nice for companies to go out there and look after consumers second and bring prices back down to where they were before the pandemic, it won’t be likely. The troubling news for that is if Coca-Cola is going to continue to be twice the price it once was, then you will have to expect to see the prices of everything else follow suit. It happened in the past when inflation took our bags of chips and soda pops from a quarter to what they were before the pandemic – and it’s happening again. Maybe we could prevent it by reaching out to companies, however I digress. The additional strain that the increasing costs put the American consumer through are not easy for anyone to handle, whether you are living at the poverty level or earning as much money as an executive in a company. More of us than we think are affected by these price changes as we are no longer able to get what we once had, unless we skimp on other areas of our lives.Why Greed Is Not the Primary Motivator in Our Current Economy – But Getting Back to a Baseline

How Inflation Is Reshaping the American Household – And What People Have Been Doing About It

It is estimated that about 65% of Americans are financially unhealthy and unable to manage their finances.

Read the full white paper to see how much money Americans are losing each year.

Some people have cut costs on food, while others have limited distribution into their investment accounts or pulled them out in their entirety of fear of where the market will go, as the word recession has been tossed around for an overextended period of time. For a breakdown of U.S. consumer spending in 2021, click here These pressures and fears of entering into a recession, along with being limited by what we could do with our lives, only pushes us back into a place of fear and discomfort. Now being in this type of place is horrible for the regular consumer and American citizen. It puts us in a place where we tend to go out and envy what others do, even if they may be frivolous with their money and how they spend it. Ever since Instagram came out, content creators have competed on how they could curate the perfect feed to draw people in to watch their perfect lives. As spectators, we watch people go out there and live their best lives. It translates into our society as well, where instead of being responsible, people start bragging about what they are doing in front of their friends. For a millennial, that term would be considered flexing. And what it looks like is when someone buys a designer item or plans to go on a fancy vacation and starts telling all their friends to make them jealous about what they are doing. This behavior definitely has an impact on the people around them. The people who cannot afford to go on a trip, so often decide that they are so envious of their friend’s vacation, that the decide to go on one for themselves and put themselves into credit card debt. While others look and watch in envy, then find other ways to make up for their innate feelings of inadequacy and start shopping to fill the voids that are left within them, due to the actions of others – who may actually just be resharing old content – and not living the life that they are portraying on the Internet. It’s the culture that’s been pushed on us from social media outlets to our friends who follow their lifestyles, then shoved into our faces, so we have to feel some sort of way about it. Charlie Munger’s right. There is no more greed in our culture. Our lives aren’t fueled by how much each of us can attain anymore, or there wouldn’t be so many people out there stating that billionaires shouldn’t exist. However, there is nothing that is stopping us from envying how others are living their lives, whether online or in person, and pushing us out of our own comfort zones. For the people who are living at a much lower socioeconomic status, this becomes quite troublesome, however. That envy can so easily shift into anger, as our options for what we can do often diminishes when the costs of goods increase. How a Silent Envy Within Our Souls Is Expanded Upon – Even If We Don’t Want It to Be – Due to the Culture of Social Media

The Circular Thinking Expert Generalist Is Spot On About Where We Are As a Society – And What It’s Doing to Us As Individuals

Finance behemoths like Bloomberg and the Wall Street Journal make you pay to learn about finance. We share our insights to expand your financial literacy for free.

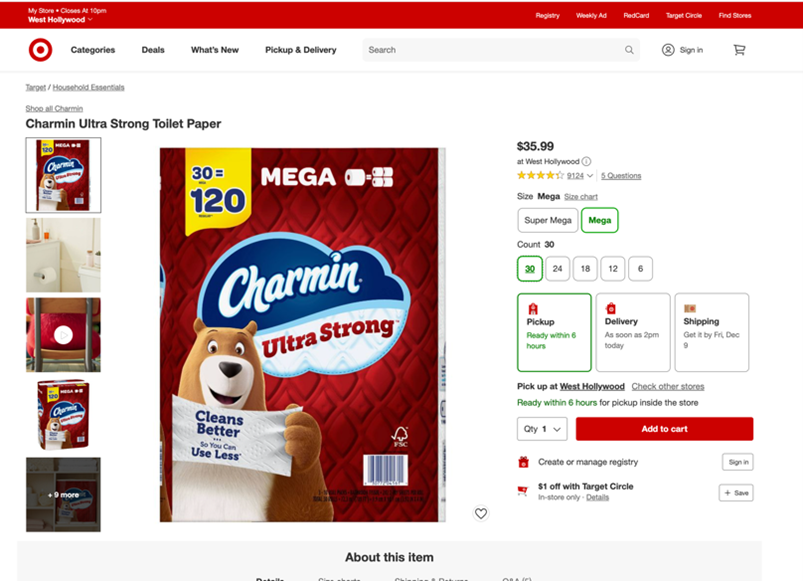

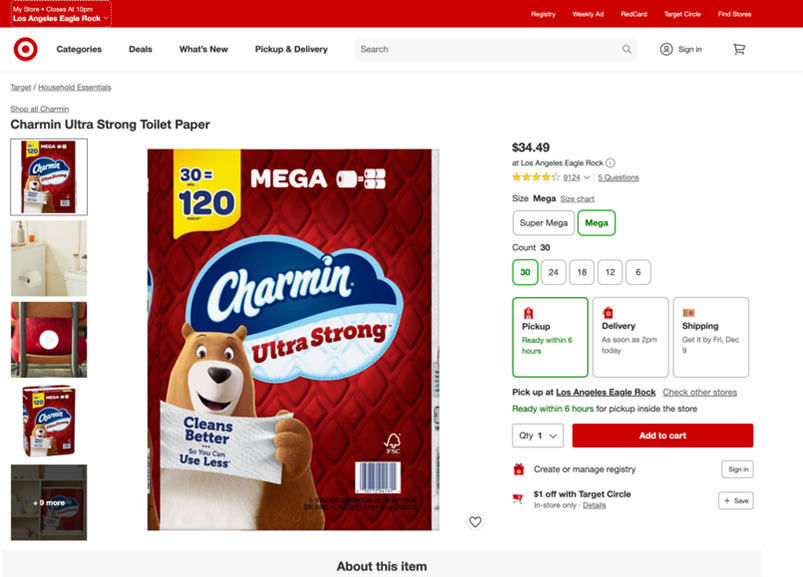

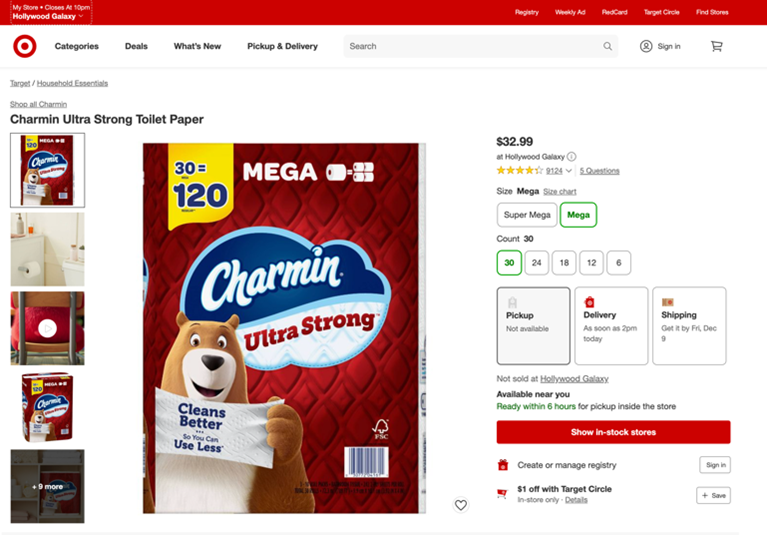

We are here, exactly as Charlie Munger called it, in a world of envy over greed. And it doesn’t just hurt us in the here and now – but it is destroying the future that we want to create for ourselves when it comes time to retire. We’re fueling companies' profit books with our pocketbooks because we want to go out there and try to live fractionally better than we can afford because so much of our entertainment content, along with our friends that are pushing us into that direction. Those small luxuries offered by companies get us to overlook things we should be paying attention to, such as the fact that Target has various pricing across their stores from location to location. If you happen to open the Target app, you will find that the West Hollywood location charges different prices than both the locations in Hollywood and in Eagle Rock, which is unusual, as all three locations are just a few miles away from each other. To most people, they would look at that pricing structure and come to the realization that it does not cost more to deliver items from a truck to one store or another, and that can be quite off-putting for a brand to start following the Silicon Valley model of pricing, where you own the market, then charge as much as possible for your products and services, which is exactly what this type of behavior looks like. Most people aren’t going to have the level of understanding that the landlord for that retail real estate complex tried to double the rent for all the commercial businesses there, as that was the reason the retailer Game Stop closed their location. They also aren’t going to realize that unlike McDonalds, these types of companies aren’t purchasing the real estate that they operate out of – and landlords are hurting so much from the lack of occupancy of their smaller outlets – that they are gouging businesses for as much as they can in their larger commercial development projects. But for a consumer, they are so tied into the glitz and glamour that the Target brand and their stores emit that they don’t even realize that they must be comparing prices for their own products, from store to store, within a singular brand. What We Can Do About Earning Back Some of The Money We Are Losing Through Our Envious Actions

The mismanagement of personal finances cost Americans a total of more than $352 billion in 2021.

Read the white paper to see how much your household may have been impacted.

That envy isn’t just tied to products and services: it also makes it's way all the way down to food. Consumers often overlook the charges that are associated with a food delivery app, where some have fees embedded as high as $6 just to process the order, on top of the markups that are made from the application to the restaurant itself, to make up for the margins that the application takes away from the small business. While many people have scaled back their spending, there are many who haven’t. Considering we are not able to go out there and get the same amount of goods as our currency once could, we should really look at this envy that is within ourselves. What is it doing and what are the damages that it is causing in our lives, especially when it comes to our future? In this economy, we should really be considering what we can do to limit our spending. As difficult as it is to cut down on our finances when we are already facing higher prices, it is possible. If we take a look at our purchases out of envy, that could take a significant chunk of that money spent to be relocated back into savings or investments. If we take the time to really examine where we are spending our money and how much it costs, maybe a Costco or a Sam’s Club membership could yield higher savings than shopping at Target, just because every single Instagram influencer talks about how amazing it is. I mean, how can a store charge a different price from one location to another? It’s kind of asinine if you ask me. Sorry to my friend who left me a testimonial in my book who works there, but seriously. It’s really bad from a consumer perspective, and as a marketer who understands price as one of the four p’s that are essential to a successful business, I cannot commend something like that as it leaves a bad taste in so many consumers’ minds. Anyway, this period of inflation and/or the recession we are entering is not going to be the last one that we face in our lifetimes. There will be more, as it seems that historically, a recession of some sort has occurred every 10-20 years. Inflation tends to be a common occurrence throughout American history. Where we should be putting our money isn’t into more things that are just going to subdue that inner emotion of envy that is drawn upon us. Instead, we should be preparing for the future as there are going to be many more moments like this to come. Something I have personally worked on was unfollowing a handful of pages that showed people spending lavish amounts of money. As someone who has a decent social following, I’ve also been told that I couldn’t go out there and spend as much as I was, as people were hurting and it invokes a lot worse traits than envy in the people who have felt the hardest of hardships that arose from the pandemic. That helped me curb my spending myself. I have also taken the time to scale back on eating out, as restaurant prices going up by 30 percent allowed me to internally examine that I was getting the same thing, but for a lot more money. An example of that is the all-you-can-eat Korean barbeque place and shabu shabu place I frequented. Both once charged $30 a person, but when they moved their prices to $39, my frequency of visits went from once a week to once every other week, to now only on special occasions. Another thing to consider is that our socioeconomic status is not a finite figure throughout life, and that we will move up and down throughout the years, and more often than not, when an economic downturn occurs, people move down for months at a time through layoffs and unemployment. None of us are safe from a temporary downfall within an economy – usually wealth is redistributed in significant ways during these periods of time. Now is the time to set aside money and prepare for what is yet to come. We have our whole lives ahead of us and we need to have a safety net in case anything were to happen in the future. Do keep in mind, that if the transmission in your car were to go out, it could up cost upwards of $5,000. When I worked at Honda, the replacements ranged from $3,500 to $5,500 for an OEM (original equipment from the manufacturer) part. For a BMW or any other luxury vehicle, the costs go up significantly. We need to work to rid ourselves of the envy that our culture has instilled into us and break free and become independent of that. And for people like me who aren’t that great at investing on our own, we need to find financial advisors who can help us do so.It Might Be Time to Start Doing This – Especially with the Long-Term Damage that Is Being Caused

Recessions Are Not One-Off Situations – They Reoccur, and They Reoccur Often

We May Be Hurting in the Now – But Planning for the Future to Avoid Another Situation Like This Is Just as Important

We're on a mission to reduce the overwhelmingly high percentage of financially unhealthy American citizens (65%) to as close to zero as possible.

Join us on our mission and sharpen your wisdom about all things money related.

If we’re already finding so much difficulty in our own shopping habits due to the silent envy that festers within us from the glorious lives others are living on social media and through our conversations with friends, then it might be time for us to question our own spending and look for help in regards to what resources are available for us to better plan our finances. There are two sides to this equation: When we examine where we spend our money in our own daily lives, we usually apply linear thinking, as mentioned above, to how purchases are made. An example of this would be that I have $200 in the bank and I see a coffee maker for $150 and I realize that I will have $50 left over, so it won’t be a bad purchase to make. The thought process is linear. I see item. I want item. Item is less than what I have in my account. If I buy it, I have money left over. This is something I should buy. This is usually how a lot of people get trapped into those purchases made out of envy, because they look at the new item they are purchasing from one dimension, through one singular straight line. If you apply circular thinking to your purchases, you can have a multitude of situations that you can plan accordingly for. Let’s say your coffee maker broke and you need a replacement. You see a designer coffee machine for $200 and you see a regular coffee machine for $50. The entirety of your purchase decision is based off what saves you the most money. A linear thinker will automatically assume the $50 machine saves money. However, there are situations where the $200 designer coffee machine, could, in fact, save money over the long haul. There are many factors to consider in a purchase like this, such as how many cups of coffee will be made and consumed, how many days or months or years each product will last, how easily one would be damaged and what the warranty on the item is, and if a free replacement is issued if there is a lifetime guarantee. Let’s say the $50 machine has to be replaced five times within a four-year period and the designer coffee machine has no issues throughout the same duration of time, that factor alone could signal that the designer coffee machine is indeed the purchase that saves money in the long run. By expanding out your equation, you can get a clearer picture of how much the true costs of the items you purchase are. For myself, I purchased two pairs of shoes. Let’s call one Gucci for example purposes, and the other Louis Vuitton. I wore Gucci every day for two years straight, but I only wore Louis Vuitton three times. When you factor in costs at that angle, if both products are the same price, then the Gucci shoes are indeed costing 243 times less than the Louis Vuitton shoes. Now the same applies to saving and investing. If we reapply the example of having $200 of spare money every single month and you decide to invest $100 of that $200 into savings every month, at a six percent annual rate of return and after 25 years, you will have $67,958. If you had just put that $100 into a bank account every month, you would have $30,000. By investing your money for 25 years, your $100 monthly contribution becomes a true value of $226.52. In other words, for every $100 you are not investing, you are losing out on around $126.52 in free money, 25 years into the future. Figuring out a financial plan comes easy to some, while difficult for others. Each of us walks our own separate journey in life, and there is nothing to be ashamed of when it comes to asking for help. I seek out help from every avenue I can – so there is absolutely nothing to be ashamed of. There are so many reliable sources out there to get the information you need to put your financial life in order. Personal budgeting helps – and a financial advisor helps as well. If you already work with a financial advisor, go back to them so you can help plan your finances accordingly, especially since we might still move into a recession.

How You Can Practice Circular Thinking in Your Finances

Getting Ahead in Life Goes Beyond Just the Here and Now – And Sometimes Requires Outside Help

We all need help getting our finances in order throughout our lifetime.

Look through our database to find the most trustworthy financial advisors in your area.

If you don’t have a financial advisor, now may be the time for you to look into getting one, so you can get through these difficult times, and make your retirement goals as well. Chances are, your goals, along with mine, were not an accurate resemblance of what we need to get to our target numbers at the golden ages. So now is the time to get the financial outlines of our lives in order. If you’re looking for a financial advisor now or in the future, please visit AdvisorCheck.com, as you can do thorough background checks of the advisors in your immediate geographic area, along with looking into advisors you may plan to work with. When you sign up for a free account, you will also have the choice to receive our updated finance and money news as we release new content. By Leonard Kim

Your go-to source for:

- Breaking out from living paycheck to paycheck

- Countering inflation with saving hacks

- Saving for your or your kid’s futures

- Turning home ownership from a dream into a reality

Disclosure The information provided in this article was written by the research and writing team at Advisorcheck.com to help all consumers in their financial journeys. Unauthorized reproduction or use of this material is strictly prohibited. Advisorcheck.com is an independent data and analytics company founded on the principles of helping to provide transparency, simplicity, and conflict-free information to all consumers. As an independent company providing conflict-free information, Advisorcheck.com does not participate, engage with, or receive funding from any affiliate marketing programs or services. To learn more about us, please go to advisorcheck.com.

Most read

The content of video and blog articles are for informational and entertainment purposes only and do not constitute investment, tax, legal, or financial advice. Always consult with a qualified professional before making any financial decisions. The views expressed are those of the author and do not reflect the opinions or recommendations of any affiliated entities.